A Biased View of Stonewell Bookkeeping

Everything about Stonewell Bookkeeping

Table of ContentsThe smart Trick of Stonewell Bookkeeping That Nobody is Talking AboutThe Buzz on Stonewell BookkeepingThe Best Guide To Stonewell BookkeepingAll about Stonewell BookkeepingThe Facts About Stonewell Bookkeeping Revealed

Every organization, from handcrafted cloth manufacturers to video game developers to dining establishment chains, earns and spends money. You might not fully understand or even start to completely appreciate what a bookkeeper does.The background of accounting days back to the beginning of business, around 2600 B.C. Early Babylonian and Mesopotamian bookkeepers kept documents on clay tablet computers to keep accounts of deals in remote cities. It was composed of a day-to-day journal of every purchase in the sequential order.

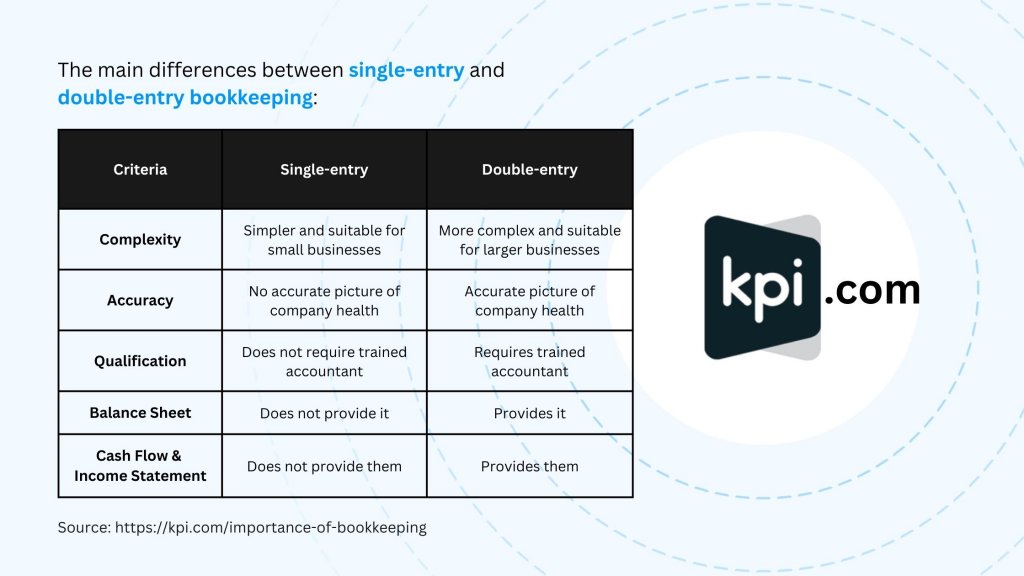

Little services might count entirely on an accountant in the beginning, however as they expand, having both experts on board becomes progressively beneficial. There are 2 main sorts of accounting: single-entry and double-entry accounting. documents one side of an economic purchase, such as adding $100 to your expense account when you make a $100 acquisition with your charge card.

All About Stonewell Bookkeeping

While low-cost, it's time consuming and susceptible to errors - https://pubhtml5.com/homepage/nrjut/. These systems immediately sync with your credit score card networks to offer you credit scores card transaction information in real-time, and immediately code all information around expenditures including tasks, GL codes, locations, and groups.

They guarantee that all paperwork complies with tax obligation guidelines and guidelines. They keep an eye on cash circulation and on a regular basis produce monetary reports that assist key decision-makers in an organization to press the business onward. In addition, some accountants additionally help in enhancing payroll and invoice generation for an organization. A successful accountant requires the following abilities: Accuracy is type in monetary recordkeeping.

They usually start with a macro point of view, such as an annual report or an earnings and loss declaration, and then pierce right into the details. Bookkeepers make sure that supplier and customer documents are constantly up to day, even as people and services adjustment. They may likewise require to coordinate with other departments to make certain that every person is using the same information.

What Does Stonewell Bookkeeping Mean?

Going into costs into the audit system permits for accurate preparation and decision-making. This aids businesses obtain payments faster and enhance money flow.

This assists prevent disparities. Bookkeepers frequently perform physical inventory counts to avoid overemphasizing the value of assets. This is an important aspect that auditors very carefully take a look at. Entail inner auditors and compare their counts with the tape-recorded values. Accountants can work as freelancers or in-house workers, and their payment varies depending on the nature of their employment.

Consultants frequently bill by the hour but might use flat-rate packages for specific tasks., the average accountant salary in the United States is. Remember that salaries can differ depending on experience, education, area, and industry.

Some Known Incorrect Statements About Stonewell Bookkeeping

-resize.jpg?token=0fac00d8975a85036711fd992adadc83)

A few of the most common documents that companies have to send to the federal government includesTransaction info Financial statementsTax compliance reportsCash circulation reportsIf your bookkeeping is up to date all year, you can avoid a lot of anxiety throughout tax obligation season. small business bookkeeping services. Persistence and attention to information are crucial to much better bookkeeping

Seasonality is a component of any type of job in the globe. For accountants, seasonality implies durations when repayments come flying in with the roofing, where having outstanding job can come to be a serious blocker. It ends up being critical to anticipate these minutes in advance and to finish any type of backlog prior to the pressure duration hits.

Not known Factual Statements About Stonewell Bookkeeping

Preventing this will minimize the danger of activating an IRS audit as it gives an accurate representation of your financial resources. Some usual to keep your personal and service funds separate areUsing a service bank card for all your service expensesHaving different checking accountsKeeping invoices for individual and business expenses separate Envision a globe where your bookkeeping is provided for you.

Staff members can respond to this message with a photo of the receipt, and it will immediately match it for you! Sage Cost Administration supplies very personalized two-way integrations with copyright Online, copyright Desktop, Sage Intacct, Sage 300 (beta) Xero, and NetSuite. These integrations are self-serve and call for no coding. It can instantly import information such as staff members, tasks, categories, GL codes, divisions, work codes, price codes, tax obligations, and extra, while exporting expenditures as costs, journal entrances, or credit report card charges More Bonuses in real-time.

Consider the following ideas: An accountant who has actually worked with businesses in your market will better recognize your details requirements. Accreditations like those from AIPB or NACPB can be a sign of trustworthiness and skills. Ask for references or examine on the internet reviews to guarantee you're employing someone trusted. is a great area to start.